Credit Corp's consumer lending well on the way

17 August 2014Credit Corp (ASX:CCP) reported FY14 results on the 5th of August coming in at the top of the outlook range to wrap up another strong year of earnings growth.

| FY14 | FY13 Underlying | % Change | |

|---|---|---|---|

| Revenue | $174.0m | $138.3m | +26% |

| NPAT | $34.8m | $29.9m | +16% |

| EPS (basic) | 75.4 cps | 65.2 cps | +16% |

| Dividend per share | 40 cps | 37.0 cps | +8% |

The core Australian PDL business remains strong but will likely be supply constrained going forward. Credit Corp's US operations is at the ready but currently running in a subdued state, waiting for supply and prices of PDLs to normalise following regulatory changes. Although much of the future growth story does sit with the huge potential of the US PDL market, it'll be the consumer lending division quietly driving growth over the next few years.

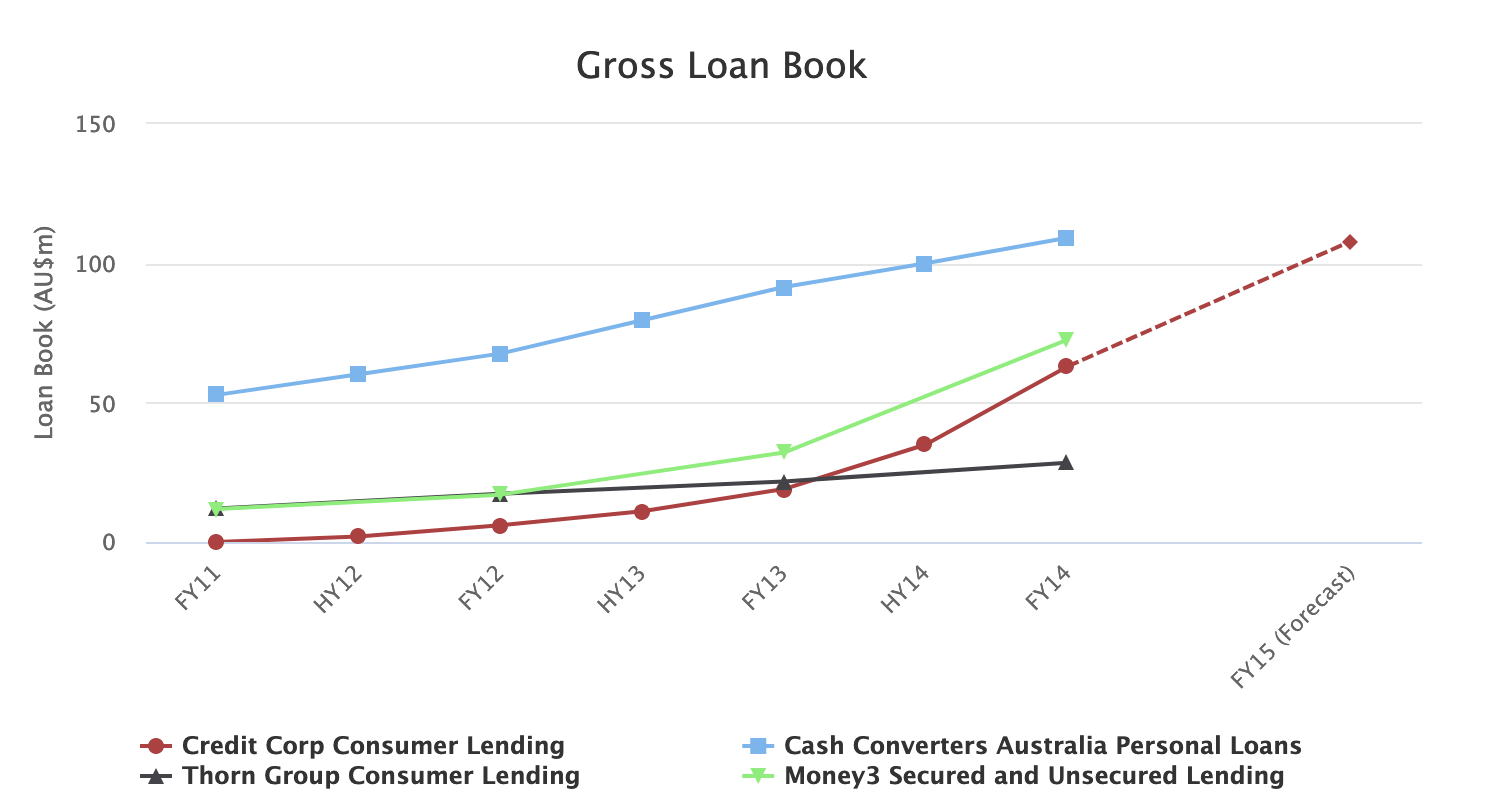

Consumer lending has really come on fast over the last year, adding $48.6m to the gross loan book with $31.6m in the last 6 months. In a blink of an eye, it's grown larger than Thorn Group's (ASX:TGA) CashFirst and is now a similar size to Money3's (ASX:MNY) secured and unsecured loan operations. Management is forecasting another $40-50m in net lending over the next 12 months, which will make it comparable in size to Cash Converter's (ASX:CCV) Australian personal loan operations. Not bad for a new business that's only three years old and done without a single capital raising!

The figures in the above graph is very rough, based on financial reports from the individual companies.

The best part is that it contributed -$2.5m NPAT to the FY14 results due to the upfront provisioning (20-25% of value) of the loans upon establishment. As a result of this provisioning model, we're unlikely to see the real contributions to the reported NPAT until 2 years after the loan book stops growing (average term is around 1-3 years).

Assuming that Credit Corp can make a 16.5% annual NPAT return12 on the net loan book. If we conservatively estimate the net loanbook will hit $100m (gross ~$125m) in FY16 and flatline from there; Provided everything else stays the same, by FY18 CCP would have added a further $16.5m to reach an annual NPAT of $51.3m. A 47.4% increase from FY14's NPAT or 10.2% annually over the next 4 years.

Consumer lending profits will begin as a drip, but will start to flow strongly. In a blink of an eye, Credit Corp has established a new pillar to compliment its core PDL business.

CCP last traded at $9.72

Disclosure: At the time of publishing I own shares in CCP.

Post updated 21/08/2014: Updated FY14 numbers of the loan book chart

-

"Credit Corp has determined that an acceptable return for a business operating in our sector represents an annual Return On Equity (ROE) in the range of 15 to 18 per cent at a modest level of gearing." - CCP 2013 Annual Report, page 5 ↩

-

"Credit Corp's lending targets the same rate of return as its PDL acquisitions." - CCP FY14 Financial Statements, page 10. ↩