No Country for Old Banks

11 August 2015International Money Transfer (IMT) services are all about transferring money from one country to another, often doing a currency conversion in between. The vast majority of this happens between banks, and in most cases the process is complicated, expensive, time-consuming and not a good experience. For those interested on understanding why this is so, I'd highly recommend reading Erin McCune's insightful article There Is No Such Thing As An International Wire.

IMT services is the primary business for Australian fintech up-and-comer OzForex (ASX:OFX). While large banks remain the incumbents in the market, OzForex and other non-bank players while tiny in comparison, are gathering steam. And with good reason. OFX has an international presence with international customers, specialise in IMT and are more agile to respond to change. This translates to a host of advantages:

Having a dedicated local presences, only the initial and final hop of the transaction need to be managed. These are generally very simple transactions between local bank accounts and foregoes having to route through multiple banking parties with additional fees. This greatly simplifies the processes making for a better customer experience as the transactions are easier to trace and troubleshoot. The costs are also easier to predict and understand.

A local presence also makes the transactions faster. Money in, and then money out - both transactions are local so most IMTs will take only around 2 business days. It doesn't have to route through an international banking network which can take most of a week. Faster is better.

Having international customers means there are a constant flow of transactions between countries. For example, there are payments made from Australia (AUD) to the UK (GBP) and vise versa. In the case where the amount of transactions between the two countries matches, OFX would just route the payments and no cross border payment would occur. The popular term for this is "netting" or even peer-to-peer transfers. OzForex currently nets approximately 40% of all transactions and this helps keep costs down. Once again, it only works if you're a global player.

Organisational agility. Being faster and with less to lose than the big financial institution allows for the execution of new product/services such as a global transactional mobile app and API integration with software-as-a-service accounting software Saasu. The latter becomes especially important if in the future companies lean towards wanting to transact with accounting portals such as Xero or Saasu, rather than through internet banking. Many incumbents won't be able to respond with technology or pricing.

Of all the smaller non-bank IMT global players, OzForex is one of the best placed. Doing over AUD$16 billion worth of turnover and 700k+ transactions annually, it has the size to address ever increasing regulatory demands where others cannot. While the loss of relationship with Westpac earlier in the year was not ideal, OFX maintains around 15 banking relationships globally and can transfer money in 47 currencies across 190 countries. Small enough to be agile, without the historical baggage nor the fear of cannibalisation - yet big enough to deal with regulatory requirements and have the necessary scale - OzForex appears to be one of the goldilocks players in massive global market measured in the trillions.

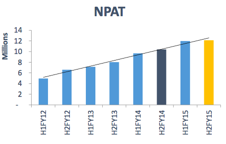

It has all the attractive properties of a "tech" company - high ROE, capital light, strong cashflows, operationally leveraged, etc. And with tremendous growth momentum highlighting that it's doing something right...

At the latest AGM event last week, management unveiled an "accelerate" strategy with a goal of doubling revenue to $200m by 2019 and in the process increasing profits by a larger percentage. I personally believe that seizing the moment and hunting growth is the correct move. The financial goals, although exciting, also feel quite achievable. With a P/E in the low-20s, this is not a typical value play, but a long-term bet on execution and significant market disruption.

OFX last traded at $2.59

Disclosure: At the time of publishing I own shares in OFX.